-

Understanding primary immunodeficiency (PI)

Understanding PI

The more you understand about primary immunodeficiency (PI), the better you can live with the disease or support others in your life with PI. Learn more about PI, including the various diagnoses and treatment options.

-

Living with PI

-

Addressing mental health

-

Explaining your diagnosis

- General care

- Get support

- For parents and guardians

-

Managing workplace issues

- Navigating insurance

-

Traveling safely

Living with PI

Living with primary immunodeficiency (PI) can be challenging, but you’re not alone—many people with PI lead full and active lives. With the right support and resources, you can, too.

-

Addressing mental health

-

Get involved

Get involved

Be a hero for those with PI. Change lives by promoting primary immunodeficiency (PI) awareness and taking action in your community through advocacy, donating, volunteering, or fundraising.

-

Advancing research and clinical care

-

Research Grant Program

-

Consulting immunologist

-

Diagnosing PI

-

Getting prior authorization

-

Clinician education

-

Survey research

-

Participating in clinical trials

Advancing research and clinical care

Whether you’re a clinician, researcher, or an individual with primary immunodeficiency (PI), IDF has resources to help you advance the field. Get details on surveys, grants, and clinical trials.

-

Research Grant Program

What is copay assistance?

To help temper high prescription costs, many individuals living with chronic disorders, including primary immunodeficiencies (PI) or inborn errors of immunity (IEI), receive copay assistance. These programs are offered by charities, nonprofits, and manufacturers of specialty medications to offset the out-of-pocket medication costs for qualifying patients. Typically, individuals that qualify for copay assistance are the most financially vulnerable patients. The amount covered by copay assistance is intended to be, and historically has been, counted toward an individual’s insurance deductible or out-of-pocket maximum, decreasing the amount of money an individual spends out of pocket before their insurance benefits kick in.

Unfortunately, over the past several years, there has been a rise in the prevalence of insurance copay accumulator and maximizer programs, which do not allow copay assistance to count toward deductibles or out-of-pocket maximums.

How do copay accumulators and maximizers affect prescription costs?

Copay accumulator and maximizer programs eliminate the long-term benefit of copay assistance to patients. They limit copay assistance to staving off the high costs of medications in the short term, but once the limit for the copay assistance program has been reached, individuals then must pay their full deductible or out-of-pocket maximum before their insurance benefits cover medication costs.

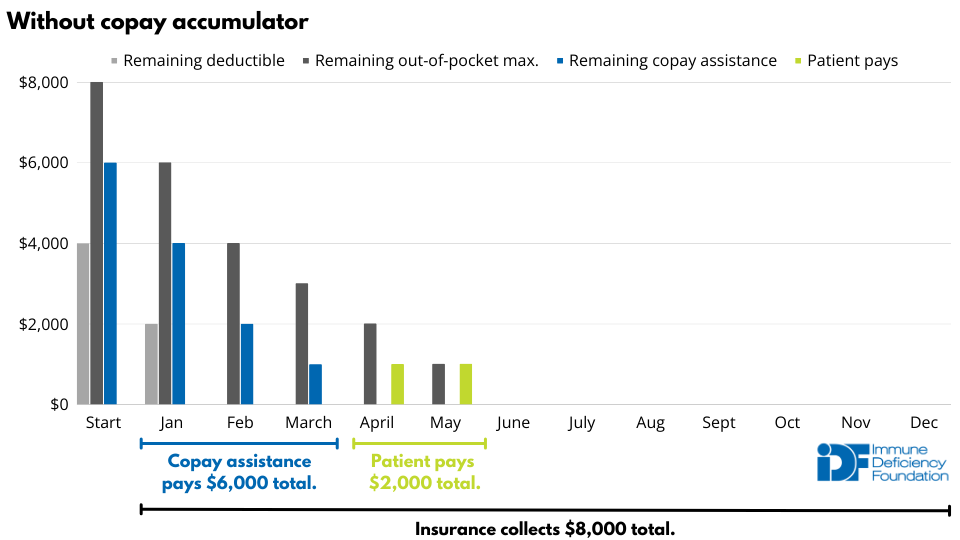

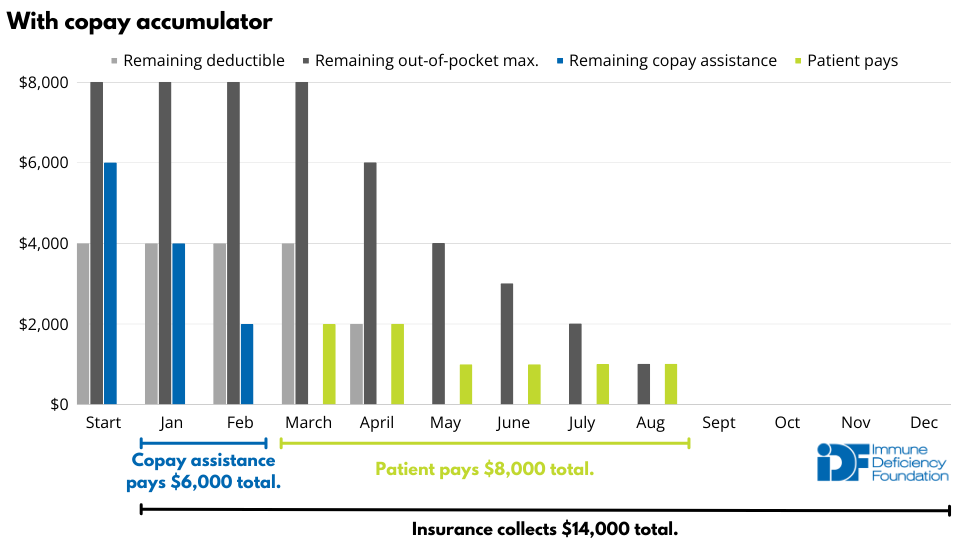

The example below demonstrates how copay accumulators shift thousands of dollars onto patients. In the example, the insurance policy includes a $4000 deductible, a $8000 out-of-pocket maximum, and a 50% copay once the deductible has been met. A patient with medication costs of $2000 per month who receives $6000 in copay assistance pays $2000 for their medication over the course of a year. That cost skyrockets to $8000, a 400% increase, if the insurance plan includes a copay accumulator policy.

Insurance providers argue that copay assistance leads patients to choose brand-name drugs over generic equivalents, leading to higher overall prescription costs. However, 99.6% of copay assistance is used for branded drugs without a generic alternative. Punishing patients who rely on drugs without generic alternatives is not fair.

It also is not fair that copay accumulators and maximizers allow for double dipping, as the insurance deductible or out-of-pocket maximum is essentially paid not once, but twice. This double dipping is the basis of the lawsuit brought by the HIV+Hepatitis Policy Institute, the Diabetes Leadership Council (DLC), and the Diabetes Patient Advocacy Coalition (DPAC). They argue that insurance companies are receiving more payment than they are entitled to under the Affordable Care Act (ACA) cost-sharing caps.

On September 29, 2023, the U.S. District Court for the District of Columbia ruled in favor of the plaintiffs, essentially reinstating a ban on copay accumulators in both federally and state-regulated insurance plans for medications that do not have generic alternatives. Initially, the Department of Health and Human Services (HHS) filed to appeal the decision, but backlash from patient organizations and Congressional members led HHS to ultimately drop their appeal.

To avoid relying solely on the court decision and because it does not adequately address copay maximizers, IDF, as a steering committee member of the All Copays Count Coalition, still advocates for a legislative solution so that the ban on copay accumulators and maximizers is written into law.

What is the difference between a copay accumulator and copay maximizer program?

Copay accumulator programs identify when insurance beneficiaries uses third party assistance to cover drug copays and do not count those payments toward beneficiaries' deductibles or out-of-pocket maximums. As a result, when the beneficiary exhausts their copay assistance, they are still responsible for cost sharing for that drug and any other healthcare services.

Copay maximizer programs use slightly different tactics with similar results. They declare certain medications to be "nonessential health benefits" to get around ACA regulations, then set the beneficiary cost sharing for these drugs based on the maximum copay assistance that a person on that drug can receive from the manufacturer. Once the copay assistance has run, the insurer then drop the beneficiary's out-of-pocket cost to zero. Unlike with copay accumulators, the beneficiary does not pay out of pocket for that particular drug. However, again, the copay assistance is not applied to beneficiary's deductible or out-of-pocket maximum, so they are met with surprise costs for other medications or healthcare services.

Sign up for Action Alerts

When policymakers need to hear the PI community’s perspective, you will receive an Action Alert by email. Customize each alert with your information and hit send. It's that easy.

Help pass state and federal legislation

IDF is closely monitoring legislation addressing copay accumulator and maximizer programs at the federal and state levels. Twenty-six states, plus the District of Columbia and Puerto Rico, have banned copay accumulators. Unfortunately, these bans do not address copay maximizers.

Use the interactive map below to explore which states/territories have banned copay accumulators.

On Nov. 1, 2021, a bipartisan group of Representatives introduced H.R. 5801, the Help Ensure Lower Patient (HELP) Copays Act, to ban copay accumulators and maximizers at the federal level. The same legislation was reintroduced as H.R.830 in the U.S. House of Representatives on Feb. 6, 2023.

Here’s how you can get copay accumulators and maximizers banned:

- Raise awareness on social media using the #AllCopaysCount hashtag.

- You can also sign up for IDF's Action Alerts to be notified when we need you to contact state or federal legislators in support of legislation banning copay accumulators.

Latest copay accumulator resources

Sign up for updates from IDF

Receive news and helpful resources to your cell phone or inbox. You can change or cancel your subscription at any time.

The Immune Deficiency Foundation improves the diagnosis, treatment, and quality of life for every person affected by primary immunodeficiency.

We foster a community that is connected, engaged, and empowered through advocacy, education, and research.

Combined Charity Campaign | CFC# 66309