-

Understanding primary immunodeficiency (PI)

Understanding PI

The more you understand about primary immunodeficiency (PI), the better you can manage it. Learn about PI diagnoses and treatment options.

-

Living with PI

-

Addressing mental health

-

Explaining your diagnosis

- General care

- Get support

- For parents and guardians

-

Managing workplace issues

- Navigating insurance

-

Traveling safely

Living with PI

Living with primary immunodeficiency (PI) can be challenging, but you’re not alone—many people with PI lead full and active lives. With the right support and resources, you can, too.

-

Addressing mental health

-

Get involved

Get involved

Be a hero for those with PI. Change lives by promoting primary immunodeficiency (PI) awareness and taking action in your community through advocacy, donating, volunteering, or fundraising.

-

Advancing research and clinical care

-

Research Grant Program

-

Consulting immunologist

-

Diagnosing PI

-

Getting prior authorization

-

Clinician education

-

Survey research

-

Participating in clinical trials

Advancing research and clinical care

Whether you’re a clinician, researcher, or an individual with primary immunodeficiency (PI), IDF has resources to help you advance the field. Get details on surveys, grants, and clinical trials.

-

Research Grant Program

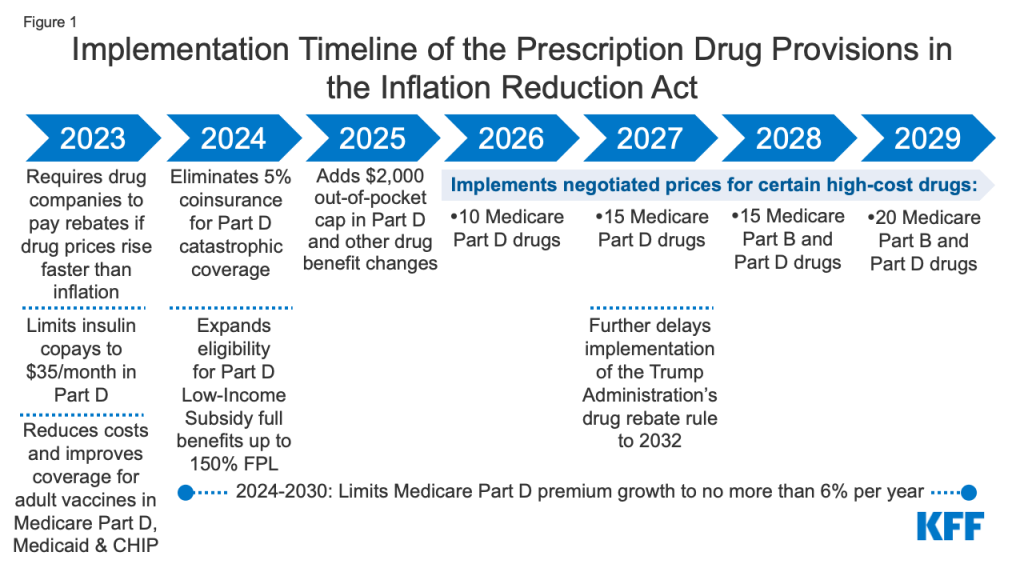

On August 16, President Biden signed the Inflation Reduction Act of 2022 into law. This wide-ranging legislation contains several provisions to combat healthcare costs, particularly for prescription drugs. Many of the healthcare provisions target Medicare and don’t apply directly to private insurance. However, health policy researchers predict spillover effects to private insurance plans as well.

Medicare Will Negotiate Drug Prices

For the first time, the new law allows the Centers for Medicare and Medicaid Services (CMS) to negotiate the price of high-cost drugs with manufacturers. National health services in other countries routinely negotiate drug prices and the Congressional Budget Office (CBO) estimates that this provision alone will save Medicare over $100 billion dollars over the next ten years.

Negotiating drug prices won’t just benefit those enrolled in Medicare. Although the U.S. does not have a centralized health system, Medicare, with more than 63 million beneficiaries, provides a benchmark for many private insurers. Experts expect Medicare’s new negotiating power to provide bargaining power to private insurance plans as well.

It’s important to note that Medicare’s negotiating power will not apply to all drugs on the market. Only the price of the 10 eligible drugs that account for the highest spending under Medicare Part D (pharmacy drugs) will be negotiated in 2026, with an expansion to Part B (drugs administered in a medical setting) and an increase to the top 20 highest-spend drugs by 2029. Any drug with an orphan drug designation is exempt from consideration, preserving incentives for drugmakers to develop drugs for rare disorders.

Similarly, plasma-based therapies are exempt from negotiation because their prices reflect fluctuating materials and manufacturing costs, rather than up-front research and development costs. IDF worked with others to ensure that this exemption was included in the final bill to protect access to care for patients with PI.

Capping Medicare Drug Costs

Several other provisions in the new law will also lower drug costs. In 2023, Medicare beneficiaries will no longer pay out of pocket for any recommended adult vaccines. Kaiser Family Foundation (KFF) found that 4.1 million enrollees received adult vaccines under Part D in 2020.

Medicare will also cap the growth of drug prices beginning in 2023. If manufacturers increase the cost of their drugs faster than the rate of inflation, they will have to pay rebates to Medicare. Again, because Medicare plays a large role in the U.S. healthcare market, this inflation cap is likely to influence what private insurance plans are willing to pay for drugs as well.

The provision with the largest potential impact on individual enrollees is a new cap on out-of-pocket costs for drugs covered under Medicare Part D (pharmacy drugs). By the end of its phased rollout, this cap is expected to directly lower costs for more than 1.4 million people enrolled in Medicare.

Currently, Medicare out-of-pocket drug costs aren’t capped, but beneficiaries enter a “catastrophic coverage” phase once they have spent $7,050 on Part D medications. Under catastrophic coverage, beneficiaries pay 5% of drug costs out of pocket for the remainder of the year. For 2024, the new legislation drops out-of-pocket costs to zero when beneficiaries hit Part D catastrophic coverage. And starting in 2025, catastrophic coverage will no longer apply at all, since Part D drug costs paid by the patient will be capped at $2,000 per year.

Extending Health Insurance Subsidies

Aside from prescription drug prices, the affordability of health insurance premiums is a concern, especially for those purchasing their own coverage. The Inflation Reduction Act extends important tax credit expansions for those purchasing health insurance through Affordable Care Act (ACA) marketplaces. The enhanced credits were set to expire at the end of 2022, but will now continue through 2025.

The expansion of tax credits for ACA plans was originally put in place by the American Rescue Plan Act of 2021. Subsidies increased for those already eligible for them and were expanded to individuals making more than 400% of the federal poverty line for the first time. According to a KFF analysis, the enhanced subsidies ensure that no one purchasing an ACA mid-level silver plan spends more than 8.5% of their income on health insurance premiums.

Overall, the Inflation Reduction Act will lower healthcare costs for Medicare beneficiaries the most, but will also impact costs for those on private insurance plans.

Related resources

Sign up for updates from IDF

Receive news and helpful resources to your cell phone or inbox. You can change or cancel your subscription at any time.

The Immune Deficiency Foundation improves the diagnosis, treatment, and quality of life for every person affected by primary immunodeficiency.

We foster a community that is connected, engaged, and empowered through advocacy, education, and research.

Combined Charity Campaign | CFC# 66309